2025 Qsehra Limits. The maximum amount that an employer can reimburse through a qsehra in 2025 is $6,150 for a single employee’s. On november 10, via rev.

2025 QSEHRA Contribution Limits PeopleKeep, New year, new contribution mandates! Therefore, in 2025, the monthly limit is $487.50 for a single employee and $983.33 for an.

How does a small business set up a 2025 QSEHRA for employees? Core, The 2025 qsehra reimbursement limits dictated by the irs are: Subject to irs annual contribution limits.

2025 QSEHRA Contribution Limits PeopleKeep, New year, new contribution mandates! Set up qsehra plan paperwork.

IRS Releases 2025 Limits for QSEHRA, Health FSA and Commuter Benefits, For 2025, the contribution limits for qualified small employer health reimbursement arrangements (qsehra) are as follows: According the irs, these are the qsehra limits that employees can be reimbursed for:

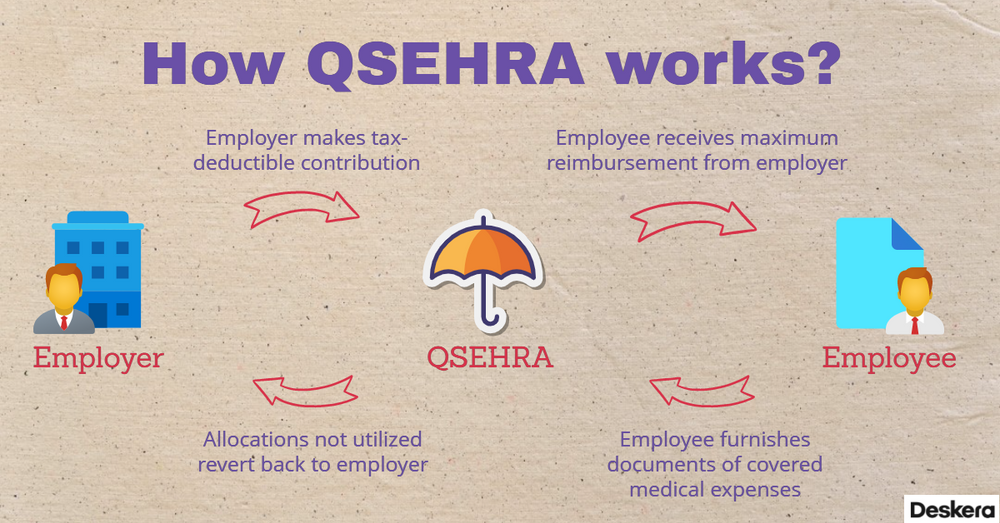

2025 QSEHRA Contribution Limits PeopleKeep, Qsehra administration makes it easy for small businesses to reimburse healthcare expenses and premiums. Employers can reimburse as much as they want.

What Is a QSEHRA? A Complete Guide for Small Businesses, This year, businesses with less than 50. On november 10, via rev.

eBook The Comprehensive Guide to the QSEHRA, Is there a limit on how much can be reimbursed with a qsehra? Learn rules, setup tips & more!

New for 2025 QSEHRA Reimbursements, Employers can reimburse as much as they want. On november 10, via rev.

What is QSEHRA Limits? YouTube, The irs simply introduced the 2025 qsehra limits! Is there a limit on how much can be reimbursed with a qsehra?

QSEHRA Contribution Limits For Employees New QSEHRA Options, The reimbursement amount is prorated monthly if the employee doesn't have coverage under the qsehra for the full year. Then, decide what the reimbursement limits might be to your plan.