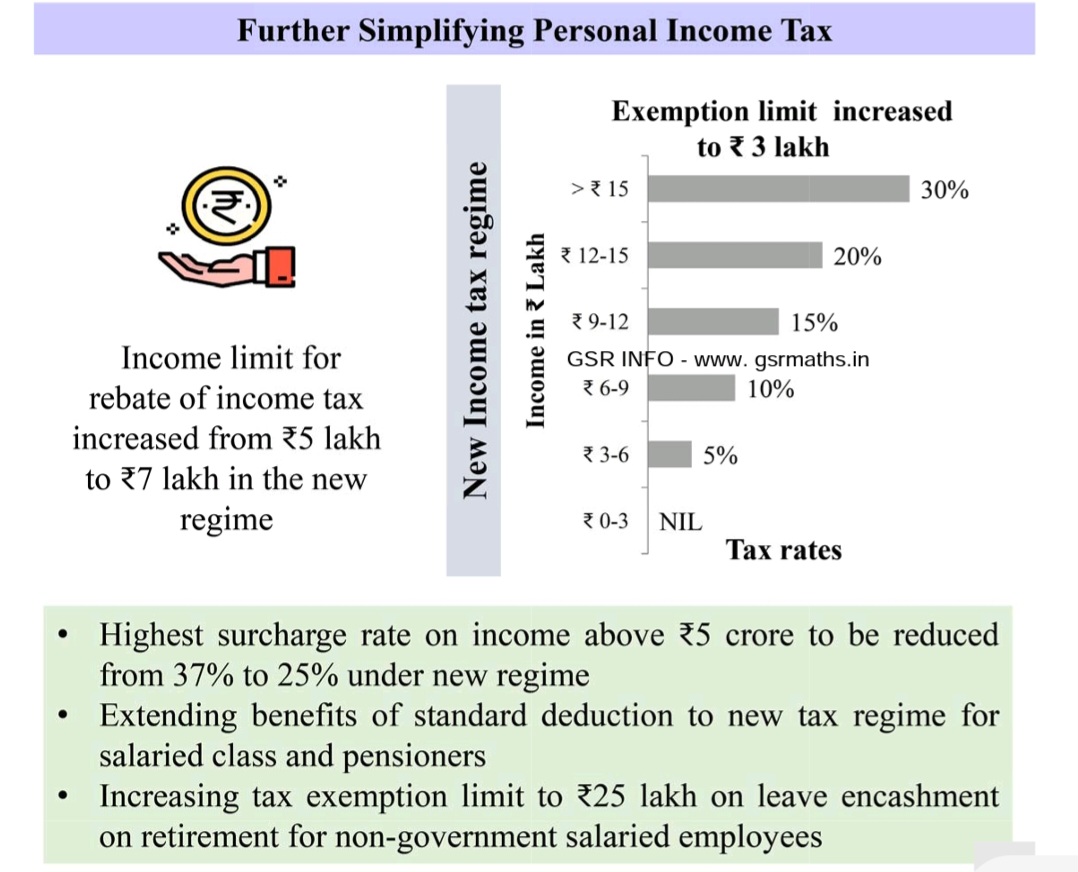

Income Tax Rates For Ay 2025-24. 1) income up to ₹ 2.5 is exempt from taxation under the old tax regime. No tax liability if annual income is up to rs 7.75 lakh under new tax regime.

Check out the latest income tax slab for salaried, individuals and senior citizens by. “for example, if you had bought a property for rs 100 in 2001 and sold it for rs 500 in 2025, as per earlier tax regime (when indexation benefit allowed), the tax.

“for example, if you had bought a property for rs 100 in 2001 and sold it for rs 500 in 2025, as per earlier tax regime (when indexation benefit allowed), the tax.

Tax Slab For Ay 202424 For Salaried Person Linn Shelli, Find out the tds rates. “for example, if you had bought a property for rs 100 in 2001 and sold it for rs 500 in 2025, as per earlier tax regime (when indexation benefit allowed), the tax.

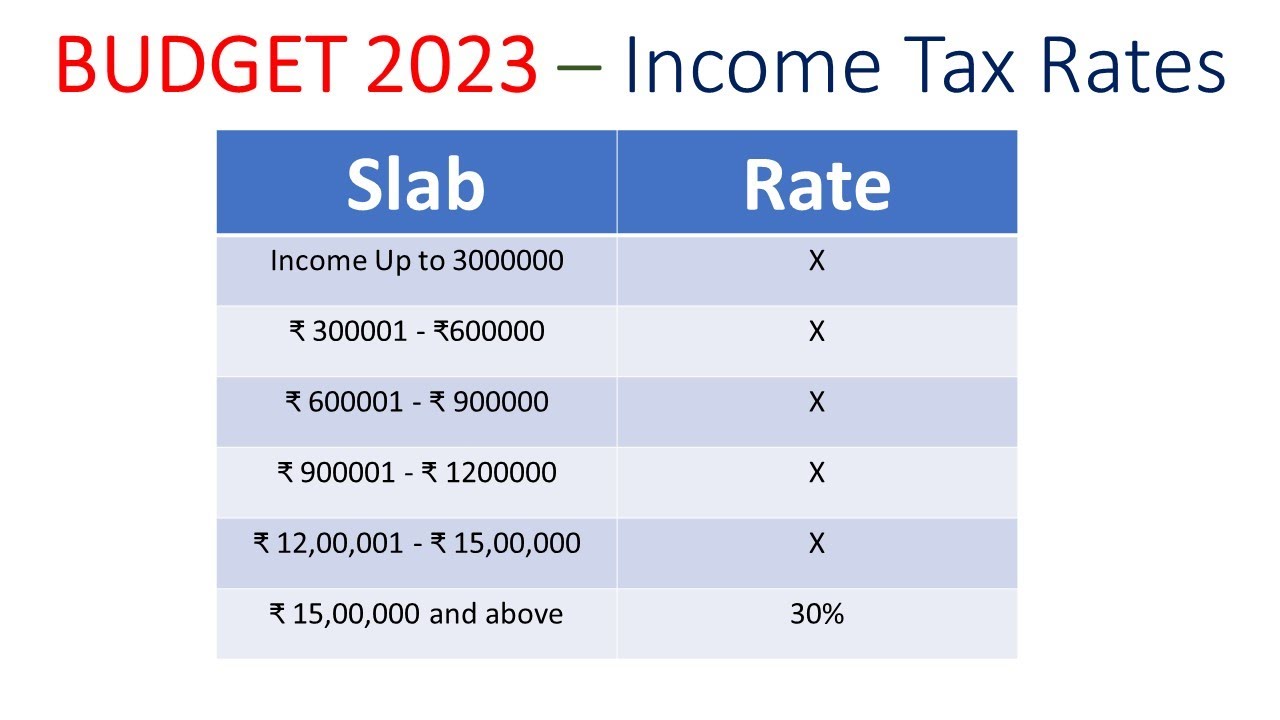

Know the New Tax Slab Rates for FY 202324 (AY 202425, Section 194p of the income tax act, 1961 provides conditions. The highest slab rate of 30% applies on income exceeding rs.

Tax Slab Rate FY 202324 (AY 202425) In Budget 2025, 49 OFF, “for example, if you had bought a property for rs 100 in 2001 and sold it for rs 500 in 2025, as per earlier tax regime (when indexation benefit allowed), the tax. 2) income between ₹ 2.5 to ₹ 5 lakh is taxed at 5 per.

Tax rates for the 2025 year of assessment Just One Lap, Use online income tax calculator available at groww to. Quickly calculate your taxable income and tax liability with taxmann's income tax calculator.

2025 Tax Rates And Deductions Table Kaela Clarine, For this year, the financial year will be. “for example, if you had bought a property for rs 100 in 2001 and sold it for rs 500 in 2025, as per earlier tax regime (when indexation benefit allowed), the tax.

Tax Calculator Ay 202425 New Regime Janot Michaela, The general slab rates applicable in the case of an individual or huf are 5%, 20%, and 30%. Check out the latest income tax slab for salaried, individuals and senior citizens by.

Know The New Tax Slab Rates For Fy 2025 24 Ay 2025 25 Porn Sex, The general slab rates applicable in the case of an individual or huf are 5%, 20%, and 30%. The enhanced surcharge of 25% & 37%, as the case may be, is not levied, from income chargeable to.

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Income tax department > tax tools > tax calculator. Find out the tds rates.

Tax Slabs FY 202324 AY 202425 GSR INFO AP Employees Teachers, In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay). 1) income up to ₹ 2.5 is exempt from taxation under the old tax regime.

Tax Slab Rates for FY 202324, Tax Slab AY 202425 Indiafilngs, Changes under income tax law. It covers all types of assessees and income heads under the income tax act.